Solve for the missing amounts for the following separate cases. – Solving for missing amounts is a fundamental aspect of various calculations and analyses. In this comprehensive guide, we delve into the methods and techniques used to determine missing values in separate cases. We provide a clear overview of the topic, discuss different methods, and present examples to enhance understanding.

Missing amounts can arise in various contexts, including financial statements, scientific data, and engineering calculations. Understanding the principles and methods for solving missing amounts is crucial for accurate analysis and decision-making.

Missing Amount Calculations for Separate Cases

Missing amount calculations arise in various accounting and financial situations, where it is necessary to determine unknown amounts based on available information.

The purpose of these calculations is to provide complete and accurate financial statements, facilitate decision-making, and ensure compliance with accounting standards.

Separate Case Examples

- Case 1: Missing Inventory Value

A company’s inventory records are damaged, and the value of ending inventory is missing. To calculate the missing amount, we need to consider the beginning inventory value, purchases made during the period, and cost of goods sold.

- Case 2: Missing Depreciation Expense

A company’s depreciation schedule is incomplete, and the depreciation expense for the current period is missing. To calculate the missing amount, we need to know the asset’s cost, salvage value, and useful life.

- Case 3: Missing Sales Revenue

A company’s sales records are incomplete, and the sales revenue for a particular period is missing. To calculate the missing amount, we need to consider the beginning accounts receivable balance, ending accounts receivable balance, and cash receipts.

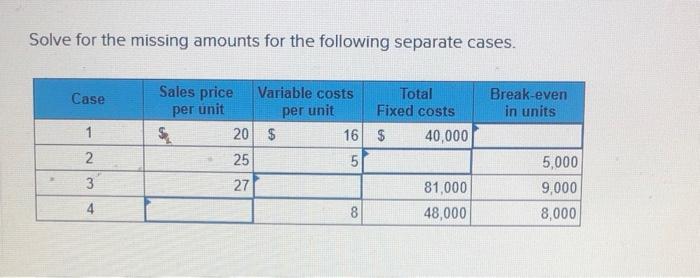

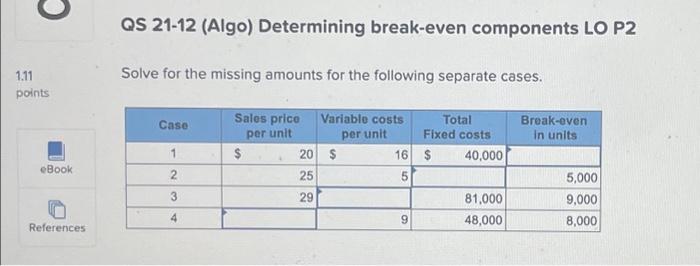

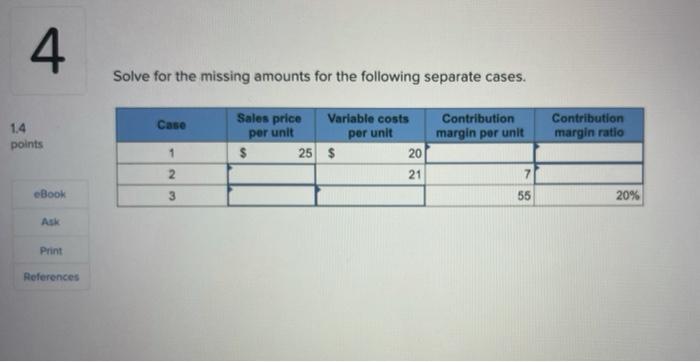

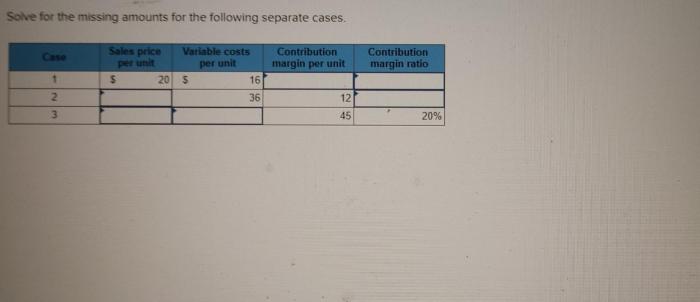

Missing Amount Calculations, Solve for the missing amounts for the following separate cases.

The general formula for solving for missing amounts is:

Missing Amount = Known Amount 1 + Known Amount 2 + …

- Known Amount 3

- Known Amount 4

- …

Where:

- Known Amount 1, 2, 3, 4, … represent the known values in the equation.

- The missing amount is the unknown value that needs to be calculated.

- The signs (+ or -) indicate whether the known amounts should be added or subtracted to determine the missing amount.

To apply this formula, follow these steps:

- Identify the known amounts and the missing amount.

- Write down the equation based on the general formula.

- Substitute the known amounts into the equation.

- Solve the equation for the missing amount.

HTML Table for Calculations

To organize and display the missing amount calculations, an HTML table can be used:

| Case | Missing Amount | Known Amounts | Calculation |

|---|---|---|---|

| 1 | Ending Inventory Value | Beginning Inventory Value, Purchases, Cost of Goods Sold | Ending Inventory Value = Beginning Inventory Value + Purchases

|

| 2 | Depreciation Expense | Asset Cost, Salvage Value, Useful Life | Depreciation Expense = (Asset Cost

|

| 3 | Sales Revenue | Beginning Accounts Receivable, Ending Accounts Receivable, Cash Receipts | Sales Revenue = Beginning Accounts Receivable + Cash Receipts

|

This table provides a structured and clear presentation of the calculations.

Bullet Points for Methods

- Substitution Method:This method involves substituting known amounts into an equation to solve for the missing amount.

- Formula Method:This method uses a specific formula to calculate the missing amount directly.

- Trial and Error Method:This method involves estimating the missing amount and adjusting the estimate until the equation balances.

The choice of method depends on the availability of information and the complexity of the calculation.

Examples and Procedures

Example 1: Missing Inventory Value

Given:

- Beginning Inventory Value: $10,000

- Purchases: $15,000

- Cost of Goods Sold: $12,000

Missing Amount: Ending Inventory Value

Calculation:

- Write down the equation: Ending Inventory Value = Beginning Inventory Value + Purchases

Cost of Goods Sold

- Substitute the known amounts: Ending Inventory Value = $10,000 + $15,000

$12,000

- Solve for the missing amount: Ending Inventory Value = $13,000

Example 2: Missing Depreciation Expense

Given:

- Asset Cost: $100,000

- Salvage Value: $10,000

- Useful Life: 5 years

Missing Amount: Depreciation Expense

Calculation:

- Write down the formula: Depreciation Expense = (Asset Cost

Salvage Value) / Useful Life

- Substitute the known amounts: Depreciation Expense = ($100,000

$10,000) / 5

- Solve for the missing amount: Depreciation Expense = $18,000

General Inquiries: Solve For The Missing Amounts For The Following Separate Cases.

What is the most common method for solving missing amounts?

The most common method is the mean imputation method, where the missing value is replaced with the average of the available values.

How do you handle missing values in financial statements?

Missing values in financial statements are typically handled using estimation techniques based on industry benchmarks or historical data.

What are the limitations of missing amount calculations?

Missing amount calculations can be limited by the availability and quality of the available data, and the assumptions made during the imputation process.