How to forecast in capsim – In the captivating world of Capsim, forecasting holds the key to unlocking strategic success. Dive into this comprehensive guide to master the art of forecasting, empowering you to make informed decisions and navigate the competitive landscape with confidence.

This in-depth exploration will unveil the types of forecasting methods, the significance of data analysis, the intricacies of forecasting models, and the techniques for ensuring accuracy. Embrace the best practices and avoid common pitfalls to elevate your forecasting skills and propel your Capsim performance to new heights.

Define Capsim Forecasting

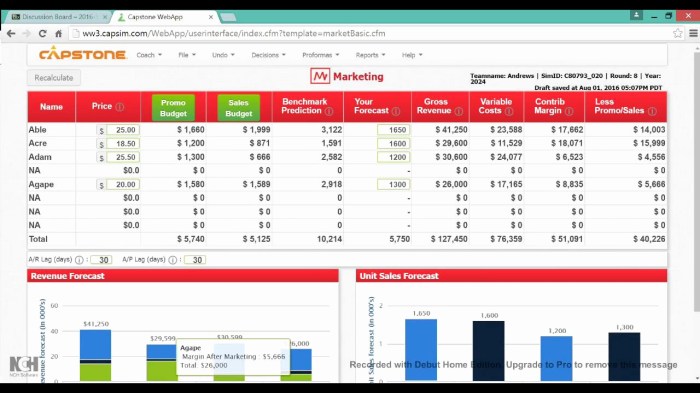

Capsim Forecasting involves predicting future events, trends, and outcomes within the Capsim business simulation.

Forecasting is crucial in Capsim as it allows teams to:

- Make informed decisions based on anticipated market conditions.

- Plan and allocate resources effectively.

- Identify potential risks and opportunities.

Types of Forecasting Methods

In Capsim, various forecasting methods are available to predict future demand, costs, and other key business metrics. Each method has its own advantages and limitations, depending on the nature of the data and the specific forecasting task.

Quantitative Methods, How to forecast in capsim

Quantitative forecasting methods rely on historical data and statistical techniques to predict future values. They are typically more accurate than qualitative methods, especially when there is a strong historical trend or pattern in the data.

- Moving Averages:Calculates the average of the most recent n data points. Simple to use and provides a smooth trend line, but can be slow to react to changes in the data.

- Exponential Smoothing:Similar to moving averages, but assigns more weight to recent data points. More responsive to changes in the data, but can overreact to short-term fluctuations.

- Regression Analysis:Establishes a mathematical relationship between the historical data and one or more independent variables. Can identify the underlying factors driving demand or costs.

- Time Series Analysis:Analyzes historical data for patterns and trends over time. Can identify seasonality, cycles, and other patterns that can be used to forecast future values.

Qualitative Methods

Qualitative forecasting methods rely on expert judgment and intuition to predict future values. They are often used when there is limited historical data or when the data is highly volatile.

- Executive Opinion:A single executive or a group of executives make forecasts based on their knowledge and experience. Can be valuable when there is a high level of uncertainty, but can also be biased.

- Sales Force Composite:Sales representatives provide forecasts based on their interactions with customers. Can provide valuable insights into customer demand, but can be influenced by optimism or pessimism.

- Market Research:Surveys, interviews, and focus groups are used to gather data on customer preferences, intentions, and expectations. Can provide valuable insights into future demand, but can be expensive and time-consuming.

Hybrid Methods

Hybrid forecasting methods combine quantitative and qualitative techniques to leverage the strengths of both approaches. They can provide more accurate forecasts than either method alone.

- Expert-Adjusted Forecasts:Quantitative forecasts are adjusted based on expert judgment to account for factors that may not be captured by the statistical model.

- Scenario Planning:Multiple forecasts are developed based on different assumptions about future events. Provides a range of possible outcomes and helps to identify potential risks and opportunities.

Data Analysis for Forecasting

Data analysis is crucial in forecasting as it provides the foundation for making informed decisions. By examining historical data and identifying patterns, businesses can gain valuable insights into future trends and make more accurate predictions.

To effectively forecast in Capsim, it’s essential to collect and analyze relevant data. This includes:

- Historical sales data

- Market research reports

- Economic indicators

- Competitor analysis

Once data is collected, it should be analyzed using appropriate statistical techniques. These techniques help identify trends, correlations, and other patterns that can inform forecasting decisions.

Forecasting in Capsim is like trying to predict the weather, but with a little more math and a lot less rain. It’s all about making educated guesses based on past data and current trends. And just like the weather, forecasting in Capsim can be tricky.

But with a little practice, you’ll be able to forecast like a pro. And remember, if you’re ever feeling overwhelmed, just take a deep breath and say to yourself, “Wipe yo feet honey chile.” ( wipe yo feet honey chile ) Now, back to forecasting in Capsim…

Statistical Techniques

Common statistical techniques used in data analysis for Capsim forecasting include:

- Time series analysis: Analyzes historical data to identify patterns and trends over time.

- Regression analysis: Determines the relationship between independent variables (e.g., marketing spend) and dependent variables (e.g., sales).

- Monte Carlo simulation: Generates multiple scenarios to assess the probability of different outcomes.

By utilizing data analysis and statistical techniques, businesses can improve the accuracy of their forecasts and make more informed decisions that drive business success.

Forecasting Models

Forecasting models are mathematical or statistical techniques used to predict future values based on historical data and assumptions. Capsim offers a range of forecasting models to assist users in making informed decisions.

The choice of forecasting model depends on the type of data available, the level of accuracy required, and the assumptions that can be made about the future. The following table Artikels various forecasting models available in Capsim, along with their descriptions, assumptions, and applications:

Forecasting Models in Capsim

| Model Name | Description | Assumptions | Applications |

|---|---|---|---|

| Moving Average | Calculates the average of a specified number of most recent observations. | Stationary time series, no seasonality. | Short-term forecasting, smoothing out fluctuations. |

| Exponential Smoothing | Similar to moving average, but assigns exponentially decreasing weights to older observations. | Stationary time series, gradual changes. | Short-term forecasting, capturing trends. |

| Linear Regression | Fits a straight line to historical data, predicting future values based on the slope and intercept. | Linear relationship between variables, constant variance. | Long-term forecasting, predicting changes in response to changes in independent variables. |

| Multiple Regression | Similar to linear regression, but uses multiple independent variables to predict the dependent variable. | Linear relationship between variables, constant variance. | Complex forecasting, predicting the impact of multiple factors on a dependent variable. |

| ARIMA | Autoregressive Integrated Moving Average model, captures time series patterns and trends. | Stationary time series, seasonal patterns. | Long-term forecasting, predicting future values based on past values and errors. |

For example, if you want to forecast quarterly sales for a product, you could use a moving average model to smooth out fluctuations and capture the overall trend. If you have historical data on multiple variables that affect sales, you could use multiple regression to predict future sales based on those variables.

Forecasting Accuracy and Validation

Forecasting accuracy is crucial for making informed decisions and achieving business goals. Accurate forecasts enable companies to plan effectively, allocate resources efficiently, and respond proactively to market changes.

Evaluating forecasting accuracy is essential to assess the effectiveness of forecasting models. Various methods can be used, such as:

Mean Absolute Error (MAE)

- Calculates the average of the absolute differences between forecasted and actual values.

- Simple and easy to understand.

Mean Absolute Percentage Error (MAPE)

- Similar to MAE, but expresses the error as a percentage of the actual values.

- Useful when comparing forecasts across different scales.

Root Mean Square Error (RMSE)

- Calculates the square root of the average of the squared differences between forecasted and actual values.

- Penalizes large errors more heavily than small errors.

Validating forecasting models involves assessing their performance over different time periods, data sets, and scenarios. This helps ensure that the models are robust and reliable under varying conditions. Techniques for validation include:

Holdout Sample Validation

- Divides the data into two sets: training and holdout.

- The model is trained on the training set and evaluated on the holdout set.

Cross-Validation

- Divides the data into multiple folds.

- The model is trained on all folds except one and evaluated on the remaining fold.

- This process is repeated for each fold.

By evaluating forecasting accuracy and validating models, businesses can improve the reliability of their forecasts and make better-informed decisions.

Best Practices for Capsim Forecasting

Effective forecasting in Capsim requires a combination of sound judgment, analytical skills, and a deep understanding of the game’s dynamics. Here are some best practices to help you improve your forecasting accuracy:

Before selecting a forecasting method, carefully consider the available data, the time horizon, and the level of accuracy required. Each method has its strengths and weaknesses, so choosing the most appropriate one is crucial for reliable forecasts.

Selecting the Appropriate Forecasting Method

- For short-term forecasts (e.g., next quarter), historical data and simple methods like moving averages or exponential smoothing can be effective.

- For long-term forecasts (e.g., multiple years), more sophisticated methods like regression analysis or time series analysis may be necessary.

- Consider using a combination of methods to enhance accuracy and reduce bias.

Avoid common pitfalls that can lead to inaccurate forecasts, such as:

Common Pitfalls to Avoid

- Over-reliance on historical data: While historical data provides a valuable foundation, it may not always reflect future trends.

- Ignoring external factors: Economic conditions, industry trends, and competitive dynamics can significantly impact demand.

- Making overly optimistic or pessimistic forecasts: Forecasts should be based on objective analysis and avoid personal biases.

li>Failing to validate forecasts: Regularly compare actual results to forecasts and make adjustments as needed to improve accuracy.

Questions and Answers: How To Forecast In Capsim

What is the significance of forecasting in Capsim?

Forecasting in Capsim enables you to anticipate future market conditions, plan production levels, manage inventory, and make strategic decisions to maximize profitability and outmaneuver competitors.

How can I choose the appropriate forecasting method for Capsim?

The choice of forecasting method depends on the available data, the time horizon, and the level of accuracy required. Consider using qualitative methods for short-term forecasts with limited data and quantitative methods for long-term forecasts with ample historical data.

What techniques can I use to validate my forecasting models?

To validate your forecasting models, compare the forecasted values with actual results, calculate forecast errors, and use statistical tests to assess the accuracy and reliability of your models.